Implications continue to emerge from the Sep-2012 landmark Emirates-Qantas alliance, the latest development being a codeshare covering Australia for British Airways and Cathay Pacific. Although the two are members of the oneworld alliance and at first blush may be considered partners, they had the most minimal of ties, owing to significant competition between them.

That competitive situation still exists but other factors have changed: BA's once deep partner Qantas is now a competitor, aligned with Emirates, and is establishing a Jetstar franchise on Cathay's home turf in Hong Kong. BA and Cathay are united by a common enemy – not the first occasion this reasoning has spawned an alliance – but also other factors. BA has lost its Australian network access and Cathay fits in; meanwhile Cathay will be receptive to feed to sustain its positioning after China Southern and Singapore Airlines have made large capacity increases in Australia.

Alliances are evolving, and this partnership will surely change – or go extinct – as BA becomes more familiar with new oneworld members Malaysia Airlines and Qatar Airways, with whom it will have more in common than it does with Cathay.

The proposed codeshare covers Cathay's services from Hong Kong to Adelaide, Brisbane, Melbourne, Perth and Sydney, subject to Australian regulatory approval (but some city pairs are already available for sale). BA has double daily London-Hong Kong services, one with a 747-400 and the other a 777-200, which becomes a 747-400 service from Apr-2013. BA has spoken of Hong Kong being one of the first markets for its forthcoming A380s. Slots are scarce at Heathrow and limited at Hong Kong; BA's two services depart Hong Kong within 30 minutes of each other.

Malaysia Airlines, which joined oneworld in Jan-2013, was also waiting in the wings. MAS serves Adelaide, Brisbane, Melbourne, Perth and Sydney. This option would have required BA to launch services to Kuala Lumpur, which BA has said it is interested in (without a firm timeline) following its acquisition of bmi and its precious Heathrow slots. But the option is not smooth.

MAS has gone through numerous restructures in recent years and strategy has been fluid as it changes course on many occasions, a frustration to one-time hopeful partner Qantas (which sponsored MAS' entry into oneworld). More recently MAS has opened double daily A380 service to Kuala Lumpur and London Heathrow, creating over-capacity, as MAS is short of sustainable markets for its A380.

Although BA might be interested in MAS' Australia network from Kuala Lumpur, it is not keen to become deeply involved while MAS still seeks a strategy for selling its increased capacity between London and KL. Prior to the dissolution of the JSA, which relied on Singapore as the primary Australia-Europe gateway, Mr Walsh saw potential for Kuala Lumpur to rival Bangkok as a secondary transit point.

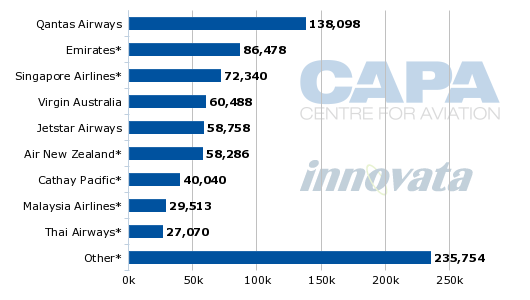

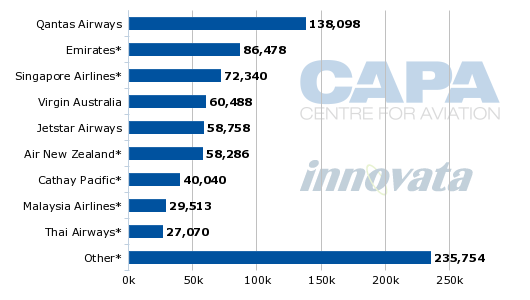

Australia international seat capacity by carrier: 25-Feb-2013 to 03-Mar-2013

Source: CAPA – Centre for Aviation & Innovata

BA in mid-2012 expressed interest to partner with China Southern (oneworld has no mainland Chinese member of its own), which could have theoretically included China Southern's growing Australia network, but this has not materialised (as in Kuala Lumpur, BA does not fly to China Southern's hub at Guangzhou, a stumbling block).

That competitive situation still exists but other factors have changed: BA's once deep partner Qantas is now a competitor, aligned with Emirates, and is establishing a Jetstar franchise on Cathay's home turf in Hong Kong. BA and Cathay are united by a common enemy – not the first occasion this reasoning has spawned an alliance – but also other factors. BA has lost its Australian network access and Cathay fits in; meanwhile Cathay will be receptive to feed to sustain its positioning after China Southern and Singapore Airlines have made large capacity increases in Australia.

Alliances are evolving, and this partnership will surely change – or go extinct – as BA becomes more familiar with new oneworld members Malaysia Airlines and Qatar Airways, with whom it will have more in common than it does with Cathay.

The proposed codeshare covers Cathay's services from Hong Kong to Adelaide, Brisbane, Melbourne, Perth and Sydney, subject to Australian regulatory approval (but some city pairs are already available for sale). BA has double daily London-Hong Kong services, one with a 747-400 and the other a 777-200, which becomes a 747-400 service from Apr-2013. BA has spoken of Hong Kong being one of the first markets for its forthcoming A380s. Slots are scarce at Heathrow and limited at Hong Kong; BA's two services depart Hong Kong within 30 minutes of each other.

Malaysia Airlines is a new ingredient in the mix

Malaysia Airlines, which joined oneworld in Jan-2013, was also waiting in the wings. MAS serves Adelaide, Brisbane, Melbourne, Perth and Sydney. This option would have required BA to launch services to Kuala Lumpur, which BA has said it is interested in (without a firm timeline) following its acquisition of bmi and its precious Heathrow slots. But the option is not smooth.

MAS has gone through numerous restructures in recent years and strategy has been fluid as it changes course on many occasions, a frustration to one-time hopeful partner Qantas (which sponsored MAS' entry into oneworld). More recently MAS has opened double daily A380 service to Kuala Lumpur and London Heathrow, creating over-capacity, as MAS is short of sustainable markets for its A380.

Although BA might be interested in MAS' Australia network from Kuala Lumpur, it is not keen to become deeply involved while MAS still seeks a strategy for selling its increased capacity between London and KL. Prior to the dissolution of the JSA, which relied on Singapore as the primary Australia-Europe gateway, Mr Walsh saw potential for Kuala Lumpur to rival Bangkok as a secondary transit point.

Australia international seat capacity by carrier: 25-Feb-2013 to 03-Mar-2013

Source: CAPA – Centre for Aviation & Innovata

BA in mid-2012 expressed interest to partner with China Southern (oneworld has no mainland Chinese member of its own), which could have theoretically included China Southern's growing Australia network, but this has not materialised (as in Kuala Lumpur, BA does not fly to China Southern's hub at Guangzhou, a stumbling block).

.jpg)

.jpg)

.JPG)

0 comments:

Post a Comment